When you choose legacy giving, your generosity becomes a lasting investment in a future where fresh, healthy food is accessible to all. There are many impactful ways to support Farm to Pantry beyond traditional donations — from including us in your estate plans or retirement accounts to giving through donor-advised funds, stock transfers, or charitable rollovers.

These thoughtful gifts create enduring change, ensuring that your values live on through a mission dedicated to reducing food waste, strengthening community bonds, and providing nutritious produce to those in need.

Explore the meaningful ways you can make a lasting impact. Your legacy will continue to bring fresh hope and nourishment to generations to come. 🌱

Charitably invest in a cause.

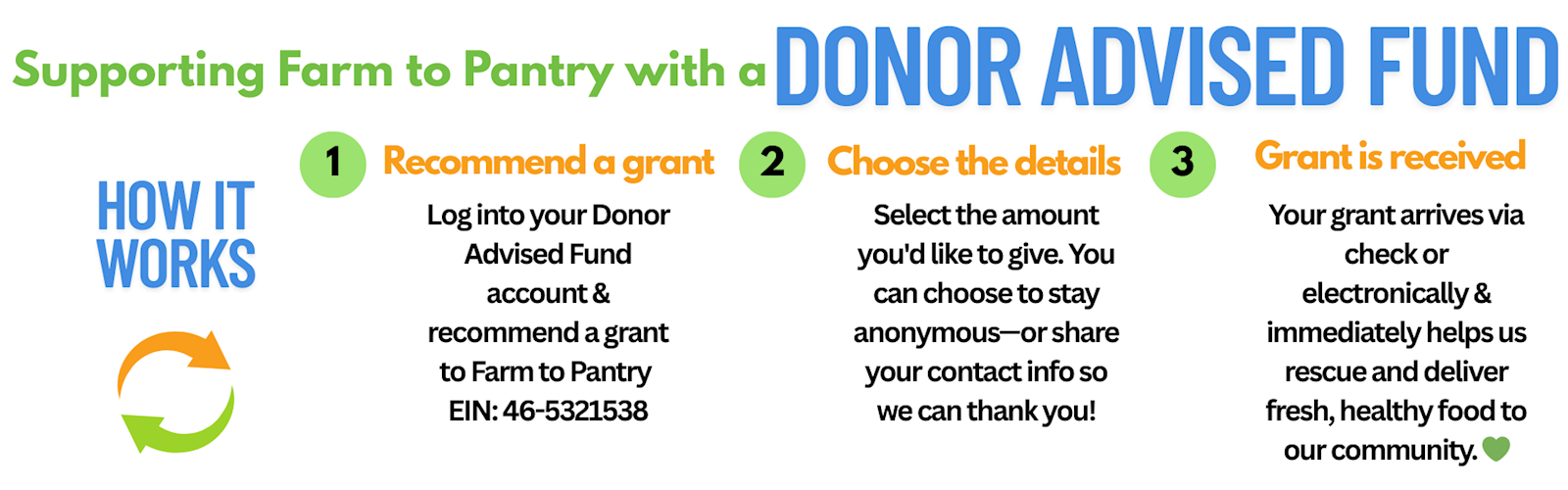

In addition to recommending immediate or recurring grants to Farm to Pantry from your Donor Advised Fund (DAF), you can name Farm to Pantry as the full or partial beneficiary of your fund.

Potential Benefits:

Donating appreciated, non-cash assets through your DAF can be a tax-wise way to support Farm to Pantry while eliminating capital gains tax.

Click here to give through DAF Direct!

Eliminate Tax on capial gains with a quick, easy gift.

Contribute long-term appreciated stock or other securities such as mutual funds and ETFs.

Potential Benefits:

By giving appreciated property lik stocks or bonds you can support local food rescue and distribution at a lower cost to you. Please consult your tax advisor to determine the full deductibility and timing of your donation.

Reduce your gross income for tax purposes.

Individuals ages 70 and a half and over can make charitable gifts directly from a tradtional IRA account without incurring ederal income tax on withdrawal. Contact your IRA administrator to transfer funds to Farm to Pantry.

Potential Benefits:

Up to $100,000 may be removed each year from your gross income for income tax purposes. (Some IRS restrictions apply) and the distribution ounts toward your required minimum distributions (RMDs).

.png)